- Q3 2019 Net Revenues $28.9 Million

- GAAP Net Loss $6.8 Million

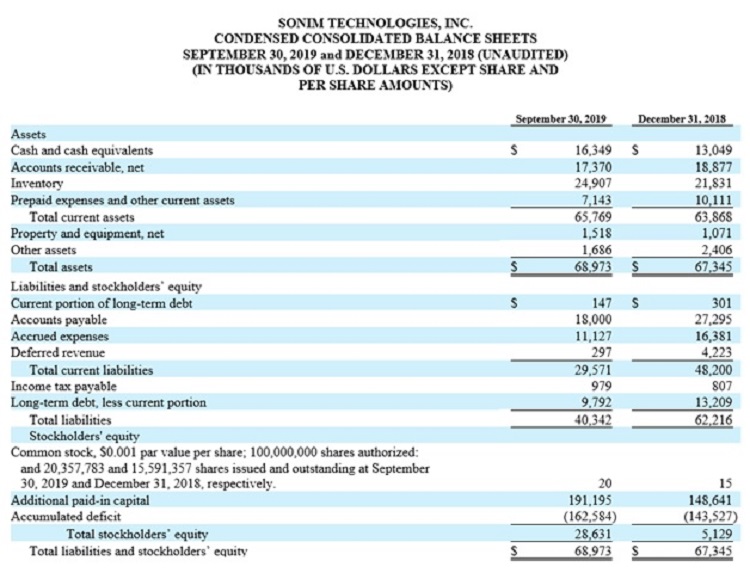

SAN MATEO, Calif. – October 30, 2019 – Sonim Technologies, Inc. (Nasdaq: SONM), a leading U.S. provider of ultra-rugged mobility solutions designed specifically for task workers physically engaged in their work environments, reported financial results for the third quarter and nine months ended September 30, 2019.

Third Quarter 2019 Financial Highlights

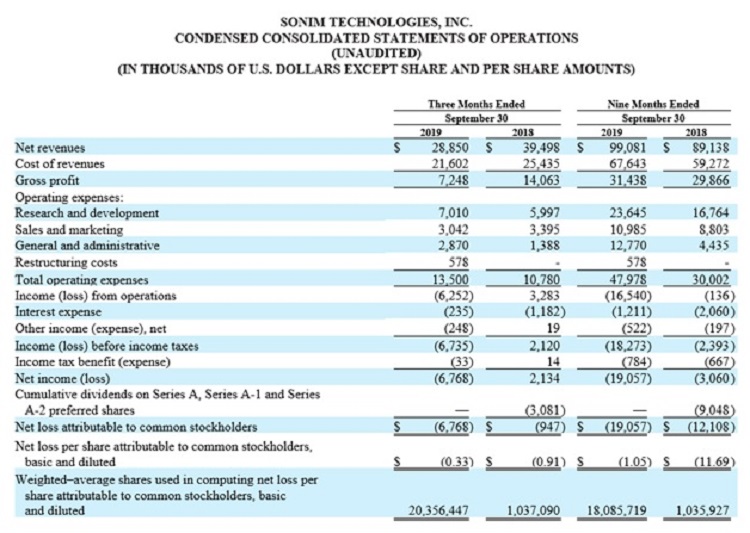

- Net revenues decreased 27% to $28.9 million from $39.5 million in Q3 2018

- Gross profit decreased 48% to $7.2 million from $14.1 million in Q3 2018

- GAAP net loss totaled $6.8 million

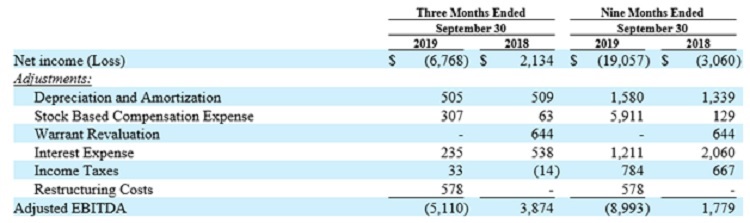

- Adjusted EBITDA loss (a non-GAAP metric reconciled below) was $5.1 million

Nine Month 2019 Financial Highlights

- Net revenues increased 11% to $99.1 million from $89.1 million in the first nine months of 2018

- Gross profit increased 5% to $31.4 million from $29.9 million in the first nine months of 2018

Executive Management Update

Effective October 29, 2019, the Board of Directors has appointed Tom Wilkinson as Chief Executive Officer for Sonim Technologies. Mr. Wilkinson served as CEO of Xplore Technologies (Nasdaq: XPLR) a maker of rugged tablet and handheld devices until it was sold to Zebra Technologies in August 2018. Recently, he was appointed as Chairman and Interim CEO of Cipherloc Corporation, which on October 15, 2019 announced that it was working to retain a permanent CEO. Mr. Wilkinson’s experience includes appointments as CFO, as well as other business leadership roles.

“Tom brings strong leadership experience as a public technology company executive, as both a CFO and CEO, with responsibility for technology development, go-to-market strategy and sales to the government and commercial sectors,” said Sonim Board Chair, Maurice Hochschild.

Sonim also announced that Bob Plaschke will assume a new role for the Company as Strategy Advisor to the Board and will devote his time to the development of strategic opportunities for Sonim. Bob has been at Sonim since 2002 and became CEO and Chairman of the Board in 2005.

“Sonim Technologies has developed a strong presence within a growing first responder market and is expanding its portfolio of solutions and customers it serves. Bringing Tom in as CEO at this time, with his deep operational experience will help Sonim execute on its growth strategies, leverage our first responder market presence and accelerate the deployment of our solutions to customers across multiple vertical markets we are targeting.” said Mr. Hochschild.

“I am thrilled with the opportunity to bring value to the shareholders of Sonim, while also supporting our core customers and their mission. The rugged device market is robust and growing, and Sonim will continue to drive forward to serve this and other markets to the fullest.” said Mr. Wilkinson.

Financial Outlook

Our new Chief Executive Officer, Tom Wilkinson, and interim Chief Financial Officer Bob Tirva will be working with the rest of the Sonim management team over the coming months to formulate a 2020 operating plan for Sonim. This plan will include an expansion of products and markets, as well as improve Sonim’s ability to make estimates and therefore plan its costs and operations appropriately.

While management’s planning efforts are progressing, the Company continues to drive carrier subsidization of Sonim phones and placement of the phones in retail locations and to address the previously disclosed technical issues with its XP8 smartphone, and other devices, which launched at a number of carriers this year. These and other issues along with the recent changes in senior leadership have impacted management’s ability to provide an accurate forecast of its near-term financial results. As a result of these conditions, the company has elected to suspend its practice of providing forward-looking financial guidance.

The Company believes that there is a robust and growing market for rugged cellular devices in the public safety market. This growth will allow for the introduction of increasingly innovative rugged solutions that will cross over to other market use cases.

Third Quarter 2019 Financial Results

Net revenues for the third quarter of 2019 decreased 27% to $28.9 million from $39.5 million in the third quarter of 2018. The decrease in net revenues was primarily attributable to lower volumes for the XP8 smart phone and XP5 feature phones sold to US carriers.

Our smartphones include the XP6, XP7, and XP8 models. The number of smartphone units sold during the three months ended September 30, 2019 compared to the three months ended September 30, 2018 decreased by 57%, primarily due to decreased demand for older XP7 and XP6 models, and introduction of the XP8. Our feature phones include the XP3, XP5, and XP5s models. The number of feature phone units sold during the three months ended September 30, 2019 compared to the three months ended September 30, 2018 increased by 63% primarily due to increased demand for the XP5s from several carriers and the introduction of our newest feature phone, the XP3. Total unit sales increased 2% to 95,000 units compared to approximately 93,000 units sold in Q3 2018. With the introduction of the higher volume XP3 in the second quarter of 2019, feature phones represented about 79% of unit sales compared to approximately 49% in Q3 of 2018.

Gross profit for the third quarter of 2019 decreased 48% to $7.2 million (25% of net revenues) from $14.1 million (36% of net revenues) in the third quarter of 2018. The decrease in gross profit was primarily attributable to a one-time reserve adjustment of $2.8 million related to the aging of materials and finished goods and a different product mix in the three months ended September 30, 2019 versus 2018.

Net loss attributable to common stockholders for the third quarter of 2019 totaled $6.8 million or $(0.33) per basic and diluted share (based on 20.4 million shares), compared to net loss attributable to common stockholders of $0.9 million, or $(0.91) per basic and diluted share (based on 1.0 million shares), in the third quarter of 2018. The higher net loss attributable to common stockholders for the third quarter 2019 compared to the third quarter 2018 was primarily driven by a decrease in net revenues of $10.6 million and higher operating expenses of $2.7 million (which includes one-time charges for restructuring costs of $0.6 million).

Adjusted EBITDA (a non-GAAP metric reconciled below) for the third quarter of 2019 decreased $9.0 million to a loss of $5.1 million from a gain of $3.9 million in the third quarter of 2018. The decrease in adjusted EBITDA was primarily due to an increase in net loss.

Nine Month 2019 Financial Results

Net revenues for the first nine months of 2019 increased 11% to $99.1 million from $89.1 million in the first nine months of 2018. The increase in net revenues was primarily due to the launch of commercial sales of the Company’s XP3 device in March 2019.

Gross profit for the first nine months of 2019 increased 5% or $1.5 million to $31.4 million (32% of net revenues) from $29.9 million (34% of net revenues) in the first nine months of 2018. The improvement in gross profit was driven primarily by an increase in net revenue of 11% from mobile phone sales. The decrease in gross margin percentage from 34% in the nine months of 2018 to 32% in the nine months of 2019 was primarily due to the one-time reserves of $2.8 million stated above as well as a different product mix compared to the same year-ago period.

Net loss attributable to common stockholders for the first nine months 2019 totaled $19.1 million, or $(1.05) per basic and diluted share (based on 18.1 million shares), compared to net loss attributable to common stockholders of $12.1 million, or $(11.69) per basic and diluted share (based on 1.0 million shares), in the first nine months of 2018. The higher net loss attributable to common stockholders of $7.0 million for the first nine months of 2019 compared to 2018 was primarily driven by an increase in operating expenses of $18.0 million, which was partially offset by an increase in net revenues of $10.0 million.

Adjusted EBITDA (a non-GAAP metric reconciled below) for the first nine months of 2019 decreased by $10.8 million to a loss of $9.0 million from a gain of $1.8 million in the first nine months of 2018. The decrease in adjusted EBITDA was primarily due to an increase in net loss of $16.0 million, lower interest expense of $0.8 million, and decrease in warrant valuation of $0.6 million, partially offset by an increase of $5.8 million in stock-based compensation expense, and $0.6 million in one-time restructuring costs.

Conference Call

Sonim Technologies will hold a conference call today, Wednesday, October 30, at 2:00 p.m. Pacific time (5 p.m. Eastern time) to discuss these results and provide an update on business conditions.

Sonim Technologies CEO Tom Wilkinson and CFO Robert Tirva will host the conference call, which will be followed by a question and answer period.

U.S. dial-in number: (877) 300-9629

International number: (470) 495-9488

Conference ID: 1293486

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at (949) 574-3860.

The conference call will be broadcast live and available for replay via the investor relations section of the Company's website.

Non-GAAP Financial Measures

Sonim provides Non-GAAP information to assist investors in assessing its operations in the way that its management evaluates those operations. Adjusted EBITDA is a supplemental measure of the Company's performance that is not required by, and is not determined in accordance with, GAAP. Non-GAAP financial information is not a substitute for any financial measure determined in accordance with GAAP.

We define Adjusted EBITDA as net income (loss) adjusted to exclude the impact of stock-based compensation expense, depreciation and amortization, interest expense, net, income tax expense, change in fair value of warrant liability and one-time restructuring costs. Adjusted EBITDA is a useful financial metric in assessing our operating performance from period to period by excluding certain items that we believe are not representative of our core business.

We believe that Adjusted EBITDA, viewed in addition to, and not in lieu of, our reported GAAP results, provide useful information to investors regarding our performance and overall results of operations for various reasons, including:

- non-cash equity grants made to employees at a certain price do not necessarily reflect the performance of our business at such time, and as such, stock-based compensation expense is not a key measure of our operating performance; and

- costs associated with certain one-time events, such as changes in fair value of warrant liability and restructuring costs, are not considered a key measure of our operating performance.

We use Adjusted EBITDA:

- as a measure of operating performance;

- for planning purposes, including the preparation of budgets and forecasts;

- to allocate resources to enhance the financial performance of our business;

- to evaluate the effectiveness of our business strategies;

- to periodically assess compliance with certain covenants and other provisions under our credit facilities;

- in communications with our board of directors concerning our financial performance; and

- as a consideration in determining compensation for certain key employees.

Adjusted EBITDA has limitations as an analytical tool, and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations include:

- it does not reflect all cash expenditures, future requirements for capital expenditures or contractual commitments;

- it does not reflect changes in, or cash requirements for, working capital needs;

- it does not reflect interest expense on our debt or the cash requirements necessary to service interest or principal payments; and

- other companies in our industry may define and/or calculate this metric differently than we do, limiting its usefulness as a comparative measure.

Set forth below is a reconciliation from net income (loss) to Adjusted EBITDA for the three and nine months ended September 30, 2019 and 2018, respectively:

Reconciliation of GAAP Net Loss (Income) to Adjusted EBITDA

About Sonim Technologies, Inc.

Sonim Technologies is a leading U.S. provider of ultra-rugged mobility solutions designed specifically for task workers physically engaged in their work environments, often in mission-critical roles. The Sonim solution includes ultra-rugged mobile phones, a suite of industrial-grade accessories, and data and workflow applications which are collectively designed to increase worker productivity, communication and safety on the job site. For more information, visit www.sonimtech.com.

Important Cautions Regarding Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to, among other things, future growth, profitability, continued market acceptance of the Company’s products. These forward-looking statements are based on Sonim’s current expectations, estimates and projections about its business and industry, management’s beliefs and certain assumptions made by the Company, all of which are subject to change. Forward-looking statements generally can be identified by the use of forward-looking terminology such as, “future”, "believe", "expect", "may", "will", "intend", "estimate", "continue", or similar expressions or the negative of those terms or expressions. Such statements involve risks and uncertainties, which could cause actual results to vary materially from those expressed in or indicated by the forward-looking statements. Factors that may cause actual results to differ materially include Sonim’s ability to continue to generate positive cash flow, and ability to be profitable; anticipated trends, such as the use of and demand for its products; its ability to attract and retain customers to purchase and use its products; its ability to attract wireless carriers as customers for its products; the evolution of technology affecting its products and markets; its ability to successfully address the technical issues identified with respect to its products; its ability to introduce new products and enhance existing products, as well as the other potential factors described under "Risk Factors" included in Sonim’s Quarterly Report on Form 10-Q for the three months ended June 30, 2019 and other documents on file with the Securities and Exchange Commission (available at www.sec.gov). Sonim cautions you not to place undue reliance on forward-looking statements, which reflect an analysis only and speak only as of the date hereof. Sonim assumes no obligation to update any forward-looking statements in order to reflect events or circumstances that may arise after the date of this release, except as required by law.

Sonim Technologies Contacts

Robert Tirva, Interim Chief Financial Officer

Sonim Technologies, Inc.

(650) 378-8100

Matt Glover and Tom Colton

Gateway Investor Relations

(949) 574-3860