Q2 2019 Net Revenues Up 39% to $43.7 Million, Driving 41% Increase in Gross Profit and 15% Increase in Adjusted EBITDA Over Q2 2018

SAN MATEO, Calif. – July 24, 2019 – Sonim Technologies, Inc. (Nasdaq: SONM), a leading U.S. provider of ultra-rugged mobility solutions designed specifically for task workers physically engaged in their work environments, reported financial results for the second quarter and six months ended June 30, 2019.

Second Quarter 2019 Financial Highlights

- Net revenues increased 39% to $43.7 million from $31.5 million in Q2 2018

- Gross profit increased 41% to $14.8 million from $10.5 million in Q2 2018

- On a GAAP basis, net loss totaled $6.1 million

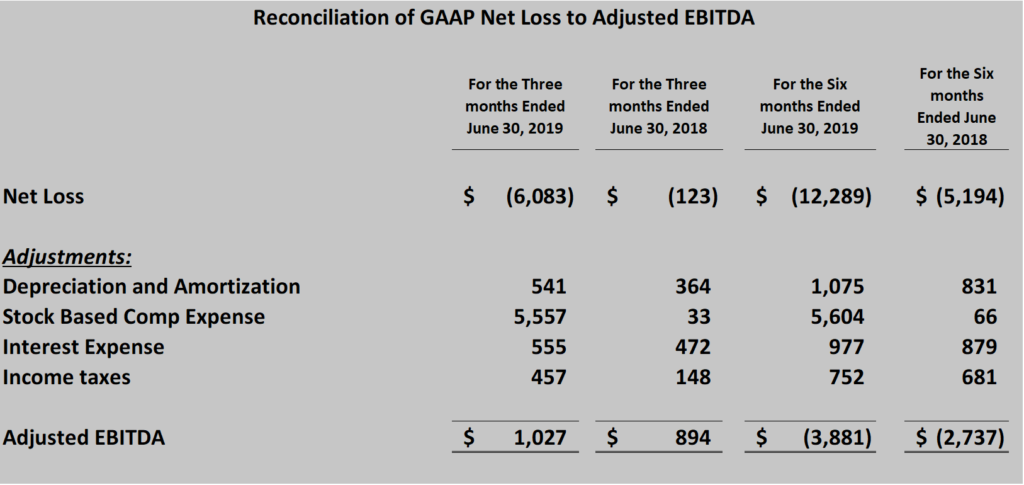

- Adjusted EBITDA (a non-GAAP metric reconciled below) increased 15% to $1.0 million from $894,000 in Q2 2018

Six Month 2019 Financial Highlights

- Net revenues increased 41% to $70.2 million from $49.6 million in the first six months of 2018

- Gross profit increased 53% to $24.2 million from $15.8 million in the first six months of 2018

Third Quarter and Fiscal 2019 Financial Outlook

- For the third quarter ending September 30, 2019, the company expects net revenues to increase to between $49 million and $52 million, representing growth of 25% to 31% compared to $39.5 million in Q3 2018.

- For the fiscal year ending December 31, 2019, the company continues to expect net revenues to increase between 25% and 30% compared to $135.7 million reported in fiscal 2018 and to achieve adjusted EBITDA profitability of between 4% and 6% of net revenues for the year as a whole.

Management Commentary

“Our success in the second quarter was driven by continued, effective sales execution, leading to the sustained operational momentum we’ve now realized over the last several quarters,” said Bob Plaschke, CEO of Sonim Technologies. “More specifically, the 39% topline growth we generated in Q2 was propelled by the first full quarter of sales of our XP3 device, along with increasing demand for our existing models, including the XP8 and XP5s. On a broader scale, our growth has been reinforced by several positive industry tailwinds and mandates, including FirstNet and the early stages of the transition from legacy land mobile radio (LMR) and push-to-talk (PTT) to smartphone and LTE networks. As the leading provider of next generation ultra-rugged mobile solutions, we are ideally positioned to further capitalize on these two market opportunities. We are encouraged by our first half results, and we expect to continue to deliver on the metrics that will drive long-term growth for our company.”

Second Quarter 2019 Financial Results

Net revenues for the second quarter of 2019 increased 39% to $43.7 million from $31.5 million in the second quarter of 2018. The increase in net revenues was primarily due to increased volumes for both the XP8 smartphone and the XP5s feature phone to major wireless carriers, as well as the first full quarter of shipments of the newly introduced XP3 feature phone. Total unit sales increased 108% to approximately 150,800 units compared to approximately 72,500 units sold in Q2 2018. With the introduction of the higher volume XP3 in the second quarter of 2019, feature phones represented about 77% of unit sales compared to approximately 46% in Q2 of 2018.

Gross profit for the second quarter of 2019 increased 41% to $14.8 million (33.9% of net revenues) from $10.5 million (33.5% of net revenues) in the second quarter of 2018. The increase in gross profit was primarily due to a decrease in manufacturing costs resulting from higher volumes.

Net loss attributable to common stockholders for the second quarter of 2019 totaled $6.1 million or $(0.34) per basic and diluted share (based on 18.1 million shares), compared to net loss attributable to common stockholders of $3.1 million, or $(3.01) per basic and diluted share (based on 1.0 million shares), in the second quarter of 2018. Net loss attributable to common stockholders in the second quarter of 2019 included a $5.2 million, or $(0.29) per basic and diluted share (based on 18.1 million shares), one-time expense related to pre-approved stock awards issued to several key employees as performance bonuses in recognition of the company’s successful initial public offering in May 2019.

Adjusted EBITDA (a non-GAAP metric reconciled below) for the second quarter of 2019 increased 15% to $1.0 million from $894,000 in the second quarter of 2018. The increase in adjusted EBITDA was primarily due to an increase in net revenues and gross profit, partially offset by higher operating expenses.

Six Month 2019 Financial Results

Net revenues for the first six months of 2019 increased 41% to $70.2 million from $49.6 million in the first six months of 2018. The increase in net revenues was primarily due to the launch of commercial sales of the company’s XP3 device in March and increased unit sales volumes for the XP8 and XP5s to major wireless carriers.

Gross profit for the first six months of 2019 increased 53% to $24.2 million (34.4% of net revenues) from $15.8 million (31.8% of net revenues) in the first six months of 2018. The increase in gross profit was primarily due to the increase in net revenues as well as the reduced manufacturing cost per unit sold compared to the first six months of 2018.

Net loss attributable to common stockholders for the first six months 2019 totaled $12.3 million, or $(0.73) per basic and diluted share (based on 17.0 million shares), compared to net loss attributable to common stockholders of $11.2 million, or $(10.78) per basic and diluted share (based on 1.0 million shares), in the first six months of 2018. Net loss attributable to common stockholders for the first six months of 2019 included a $5.2 million, or $(0.31) per basic and diluted share (based on 17.0 million shares), one-time stock bonus expense as described above.

Adjusted EBITDA loss (a non-GAAP metric reconciled below) for the first six months of 2019 totaled $3.9 million, compared to an adjusted EBITDA loss of $2.7 million in the first six months of 2018. The higher adjusted EBITDA loss was primarily due to an increase in operating expenses, partially offset by an increase in both revenues and gross profit.

Conference Call

Sonim Technologies will hold a conference call today, Wednesday, July 24, at 2 p.m. Pacific time (5 p.m. Eastern time) to discuss these results and provide an update on business conditions.

Sonim Technologies CEO Bob Plaschke and CFO Jim Walker will host the conference call, followed by a question and answer period.

U.S. dial-in number: (877) 300-9629

International number: (470) 495-9488

Conference ID: 4289209

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at (949) 574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the company's website.

Non-GAAP Financial Measures

Sonim provides Non-GAAP information to assist investors in assessing its operations in the way that its management evaluates those operations. Adjusted EBITDA is a supplemental measure of the Company's performance that is not required by, and is not determined in accordance with, GAAP. Non-GAAP financial information is not a substitute for any financial measure determined in accordance with GAAP.

We define Adjusted EBITDA as net income (loss) adjusted to exclude the impact of stock-based compensation expense, depreciation and amortization, interest expense, net, income tax expense and change in fair value of warrant liability. Adjusted EBITDA is a useful financial metric in assessing our operating performance from period to period by excluding certain items that we believe are not representative of our core business.

We believe that Adjusted EBITDA, viewed in addition to, and not in lieu of, our reported GAAP results, provide useful information to investors regarding our performance and overall results of operations for various reasons, including:

• non-cash equity grants made to employees at a certain price do not necessarily reflect the performance of our business at such time, and as such, stock-based compensation expense is not a key measure of our operating performance; and • costs associated with certain one-time events, such as expenses associated with the IPO based stock awards mentioned above, are not considered a key measure of our operating performance.We use Adjusted EBITDA:

• as a measure of operating performance; • for planning purposes, including the preparation of budgets and forecasts; • to allocate resources to enhance the financial performance of our business; • to evaluate the effectiveness of our business strategies; • to periodically assess compliance with certain covenants and other provisions under the Loan Agreement; • in communications with our board of directors concerning our financial performance; and • as a consideration in determining compensation for certain key employees.Adjusted EBITDA has limitations as an analytical tool, and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations include:

• it does not reflect all cash expenditures, future requirements for capital expenditures or contractual commitments; • it does not reflect changes in, or cash requirements for, working capital needs; • it does not reflect interest expense on our debt or the cash requirements necessary to service interest or principal payments; and • other companies in our industry may define and/or calculate this metric differently than we do, limiting its usefulness as a comparative measure.Set forth below is a reconciliation from net loss to Adjusted EBITDA for the three and six months ended June 30, 2019 and 2018.

About Sonim Technologies, Inc.

Sonim Technologies is a leading U.S. provider of ultra-rugged mobility solutions designed specifically for task workers physically engaged in their work environments, often in mission-critical roles. The Sonim solution includes ultra-rugged mobile phones, a suite of industrial-grade accessories, and data and workflow applications which are collectively designed to increase worker productivity, communication and safety on the job site. For more information, visit www.sonimtech.com.

Important Cautions Regarding Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to, among other things, future growth, profitability, continued market acceptance of the Company’s products. These forward-looking statements are based on Sonim’s current expectations, estimates and projections about its business and industry, management’s beliefs and certain assumptions made by the company, all of which are subject to change. Forward-looking statements generally can be identified by the use of forward-looking terminology such as, “future”, "believe," "expect," "may," "will," "intend," "estimate," "continue," or similar expressions or the negative of those terms or expressions. Such statements involve risks and uncertainties, which could cause actual results to vary materially from those expressed in or indicated by the forward-looking statements. Factors that may cause actual results to differ materially include Sonim’s ability to continue to generate positive cash flow, and ability to be profitable; anticipated trends, such as the use of and demand for its products; its ability to attract and retain customers to purchase and use its products; its ability to attract wireless carriers as customers for its products; the evolution of technology affecting its products and markets; its ability to introduce new products and enhance existing products, as well as the other potential factors described under "Risk Factors" included in Sonim’s Quarterly Report on Form 10-Q for the three months ended June 30, 2019 and other documents on file with the Securities and Exchange Commission (available at www.sec.gov). Sonim cautions you not to place undue reliance on forward-looking statements, which reflect an analysis only and speak only as of the date hereof. Sonim assumes no obligation to update any forward-looking statements in order to reflect events or circumstances that may arise after the date of this release, except as required by law.

Sonim Technologies Contacts

Jim Walker, Chief Financial Officer

Sonim Technologies, Inc.

(650) 378-8100

Matt Glover and Tom Colton

Gateway Investor Relations

(949) 574-3860