Sonim Technologies Reports 2019 Financial Results, Restructuring Update

SAN MATEO, Calif. – March 11, 2020 – Sonim Technologies, Inc. (Nasdaq: SONM), a leading U.S. provider of ultra-rugged mobility solutions designed specifically for task workers physically engaged in their work environments, reported financial results for the fourth quarter and full year ended December 31, 2019.

Full Year 2019 Financial Highlights

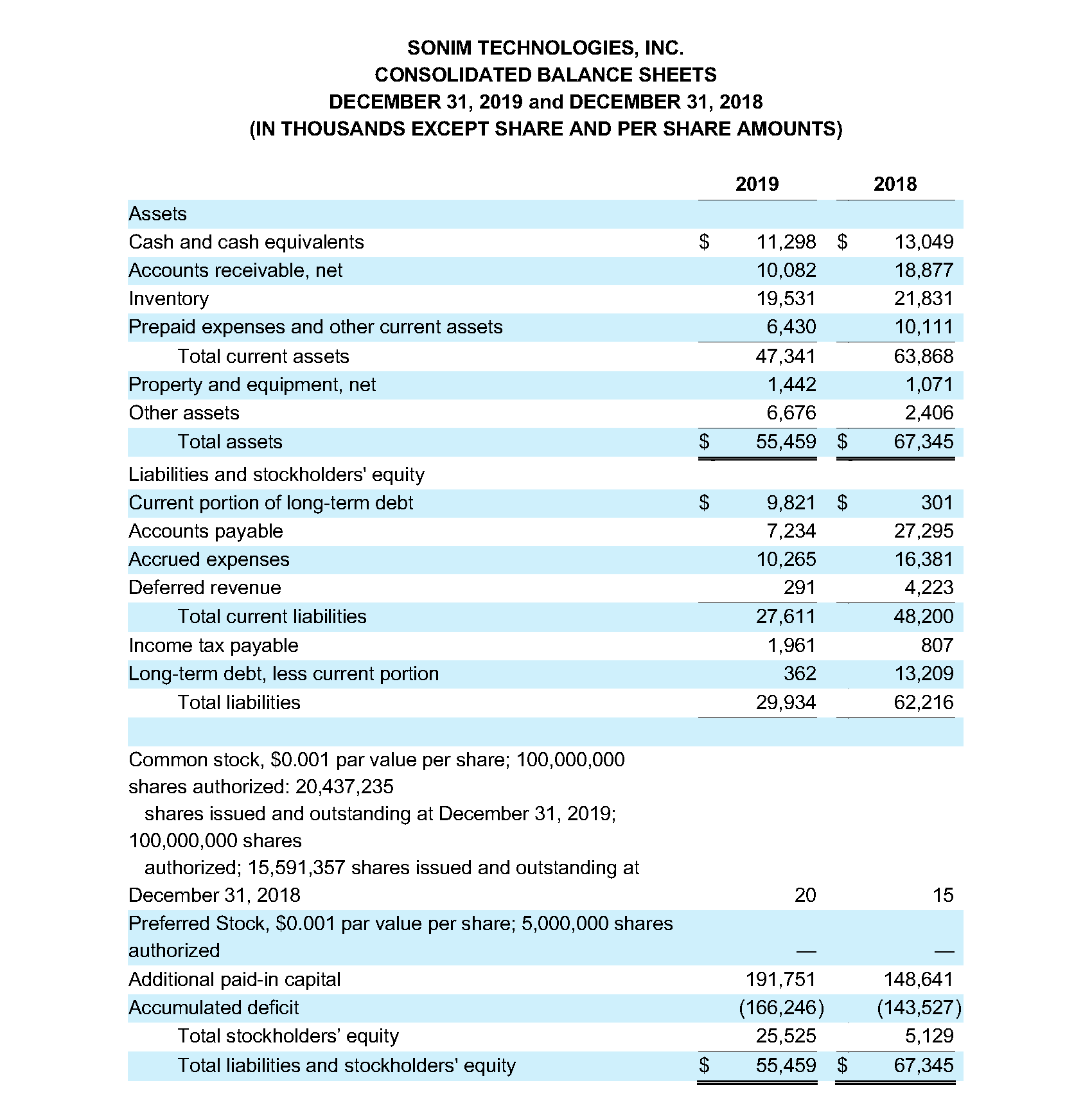

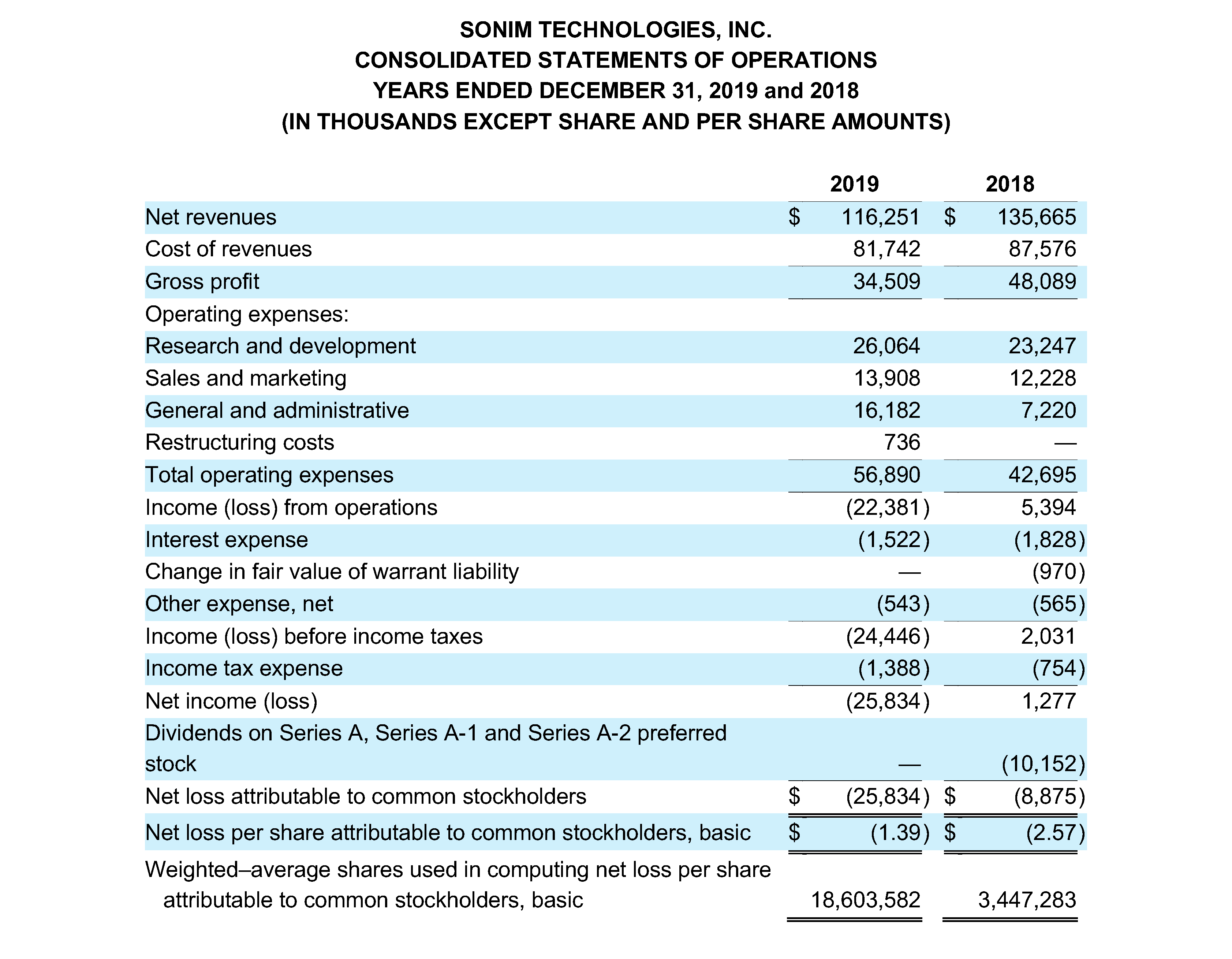

- Net revenues were $116.3 million, compared with $135.7 million in 2018

- Gross profit was $34.5 million, compared with $48.1 million in 2018

Fourth Quarter 2019 Financial Highlights

- Net revenues were $17.2 million, compared with $46.5 million in Q4 2018

- Gross profit was $4.2 million, compared with $18.2 million in Q4 2018

- GAAP net loss totaled $8.3 million

- Adjusted EBITDA loss (a non-GAAP metric reconciled below) was $4.9 million

“We have made meaningful progress on our restructuring plan over the past four months,” said Tom Wilkinson, Chief Executive Officer. “Since joining Sonim late last year, I have worked with Bob Tirva, our CFO, to closely evaluate all aspects of our business. This includes product engineering and development, supply chain, sales and marketing, distribution, partnerships, strategic opportunities and administration. Within every function of Sonim’s business, we have identified opportunities to streamline our operations and reduce costs. These changes are being implemented with rapid effect, such as a reduction in force of more than 200 positions worldwide. We are positioning Sonim to be leaner, more nimble and more effective in bringing our rugged mobility products to market so as to drive improvement in our operating results as we weather a challenging transition in our business and global economic uncertainty related to the COVID-19 virus, including specifically its impact in China.”

Restructuring Update

Since November, management has proactively reorganized the company into a leaner, lower cost organization focused on a path to growth and profitability. The company has reduced its global headcount from approximately 700 employees at year-end 2018, to approximately 500 employees as of December 31, 2019. The company executed an additional reduction in force of approximately 10% of its US employees in February 2020. Sonim also intends to relocate its headquarters to Austin, Texas, a lower cost location, as swiftly as possible.

These actions are expected to result in a run-rate savings of approximately 20% (or $12 million) from the Company’s 2019 operating expense run-rate, excluding one-time IPO related costs. Restructuring the company positions Sonim to stabilize its operations and invest for future growth.

“Sonim’s board of directors has approved an operating plan for 2020 changing how we execute our business so that we can focus not only on the needs of our customers, but also on performing well for our shareholders. We will emerge stronger and solidify our position as the leader in the rugged mobility sector,” said Wilkinson. “In addition to our actions on the operating cost side of the business, we have also taken steps to better align our inventory with our projected channel sales activity. We anticipate a challenging first portion of the year for 2020 as we make these adjustments, but we believe the adjustments are the necessary steps to realign Sonim’s operations within the rugged mobility marketplace.”

Coronavirus Impact

Sonim Technologies is closely monitoring the impact of the COVID-19 global outbreak with its top priority being the health and safety of its employees, customers, partners, and communities. While we believe our recent restructuring efforts will enable us to improve our supply chain and better address the global economic events related to the COVID-19 virus, there remains uncertainty related to the public health situation in China and elsewhere. Additionally, the Chinese government placed a moratorium on employment reductions while the crisis continues. As a result, restructuring in the Company’s China operations has been deferred until the health crisis subsides and the moratorium is lifted.

“The impact of COVID-19 has delayed the execution of certain portions of our planned restructuring actions in product development and supply chain, but at this point we believe our sales partners have ample inventory to continue meeting customer needs in the near term,” said Wilkinson. “There is an increasing likelihood that our results could be negatively impacted by an interruption in the operation of our manufacturing facility in Shenzhen, China during the first quarter. The magnitude of any potential impact is unknown, as it is unclear how long it will take for the overall supply chain to return to normal. We continue to work closely with our partners and suppliers to manage this process appropriately.”

The Company will continue to refrain from offering forward looking guidance until the COVID-19 situation achieves greater resolution and additional actions in the restructuring plan are implemented.

Conference Activity

Sonim CEO Tom Wilkinson and CFO Bob Tirva will be participating in the Roth Conference on March 16, 2020, which has been converted to a virtual event due to COVID-19 concerns. Management will be available to meet with investors via meetings arranged through the Roth Capital sales team or by contacting Matt Kreps of Darrow Associates, investor relations for Sonim, at [email protected] to request a meeting.

Fourth Quarter 2019 Financial Results

Net revenues for the fourth quarter of 2019 decreased 63% to $17.2 million, from $46.5 million in the fourth quarter of 2018. The decrease in net revenues was primarily attributable to lower volumes for the XP8 smart phone and XP5 feature phones sold to both US & International carriers.

Sonim’s smartphones include the XP6, XP7, and XP8 models. The number of smartphone units sold during the three months ended December 31, 2019 compared to the three months ended December 31, 2018 decreased by 57%, primarily due to decreased demand for older XP7 and XP6 models, and slower than expected ramp of the XP8. Feature phones include the XP3, XP5, and XP5s models. The number of feature phone units sold during the three months ended December 31, 2019 compared to the three months ended December 31, 2018 decreased by 65%, primarily due to decreases in demand for the XP5s from several carriers. With introduction of the higher volume XP3 in the second quarter of 2019, feature phones represented about 46% of unit sales in Q4 of 2019, compared to approximately 51% in Q4 of 2018.

Gross profit for the fourth quarter of 2019 decreased 77% to $4.2 million (24% of net revenues) from $18.2 million (39% of net revenues) in the fourth quarter of 2018. The decrease in gross profit was primarily attributable to the decrease in revenue, changes in product mix, a one-time reserve adjustment of $1.0 million related to inventory reserves in the three months ended December 31, 2019, and $0.4 million in amortized fulfillment costs as a result of the adoption of ASC 606. On a non-GAAP basis, adding back these one-time non-cash costs, adjusted gross profit would have been $5.6 million (33% of net sales).

Net loss attributable to common stockholders for the fourth quarter of 2019 totaled $8.3 million or $(0.41) per basic share (based on 20.4 million shares), compared to net income attributable to common stockholders of $3.2 million, or $0.31 per basic share (based on 10.5 million shares), in the fourth quarter of 2018. The higher net loss attributable to common stockholders of $11.5 million for the fourth quarter 2019 compared to the fourth quarter 2018 was primarily driven by a decrease in gross profit of $14.0 million and lower operating expenses of $1.1 million as compared to the fourth quarter of 2018.

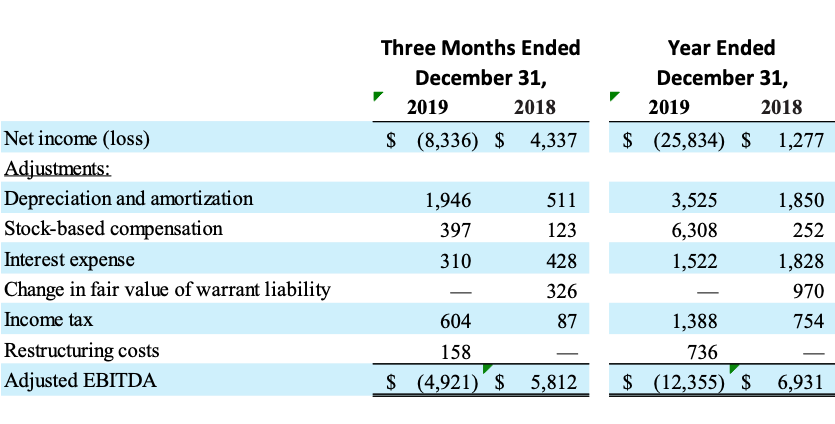

Adjusted EBITDA (a non-GAAP metric reconciled below) for the fourth quarter of 2019 decreased $10.7 million to a loss of $4.9 million, compared to a gain of $5.8 million in the fourth quarter of 2018. The decrease in adjusted EBITDA was primarily due to an increase in net loss.

Full Year 2019 Financial Results

Net revenues for the year ended 2019 decreased 14% to $116.3 million from $135.7 million in the year ended 2018. The decrease in net revenues was primarily due a decrease in average sales price due to changes in product mix and a decrease in professional service revenue.

Gross profit for the year ended 2019 was $34.5 million (30% of net revenues) compared with $48.1 million (35% of net revenues) in the year ended 2018. The decline in gross profit was primarily due to the one-time reserve of $3.1 million noted previously, changes in product mix and $1.5 million in amortized fulfillment costs as a result of the adoption ASC 606.

Net loss attributable to common stockholders for the year ended 2019 totaled $25.8 million, or $(1.39) per basic share (based on 18.6 million shares), compared to net loss attributable to common stockholders of $8.9 million, or $(2.57) per basic share (based on 3.4 million shares), for the year ended 2018. The higher net loss attributable to common stockholders for the year ended 2019 compared to 2018 was primarily driven by a decrease in gross profit of $13.6 million and an increase in operating expenses of $14.2 million, offset in part by the absence of a $10.2 million non-cash dividend payout in 2018 related to shares of convertible Series A, Series A-1 and Series A-2 preferred stock.

Adjusted EBITDA (a non-GAAP metric reconciled below) for the year ended 2019 decreased by $19.3 million to a loss of $12.4 million from a gain of $6.9 million for the year ended 2018. The decrease in adjusted EBITDA was primarily due to an increase in net loss of $27.1 million, lower interest expense of $0.3 million and decrease in warrant valuation of $0.9 million, partially offset by an increase of $6.3 million in stock-based compensation expense, an increase in depreciation and amortization of $3.5 million and $0.7 million in one-time restructuring costs.

Non-GAAP Financial Measures

Sonim provides Non-GAAP information to assist investors in assessing its operations in the way that its management evaluates those operations. Adjusted EBITDA is a supplemental measure of the Company’s performance that is not required by, and is not determined in accordance with, GAAP. Non-GAAP financial information is not a substitute for any financial measure determined in accordance with GAAP.

We define Adjusted EBITDA as net income (loss) adjusted to exclude the impact of stock-based compensation expense, depreciation and amortization, interest expense, income tax expense, change in fair value of warrant liability and one-time restructuring costs. Adjusted EBITDA is a useful financial metric in assessing our operating performance from period to period by excluding certain items that we believe are not representative of our core business.

We believe that Adjusted EBITDA, viewed in addition to, and not in lieu of, our reported GAAP results, provide useful information to investors regarding our performance and overall results of operations for various reasons, including:

- non-cash equity grants made to employees at a certain price do not necessarily reflect the performance of our business at such time, and as such, stock-based compensation expense is not a key measure of our operating performance; and

- costs associated with certain one-time events, such as changes in fair value of warrant liability and restructuring costs, are not considered a key measure of our operating performance.

We use Adjusted EBITDA:

- as a measure of operating performance;

- for planning purposes, including the preparation of budgets and forecasts;

- to allocate resources to enhance the financial performance of our business;

- to evaluate the effectiveness of our business strategies;

- to periodically assess compliance with certain covenants and other provisions under our credit facilities;

- in communications with our board of directors concerning our financial performance; and

- as a consideration in determining compensation for certain key employees.

Adjusted EBITDA has limitations as an analytical tool, and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations include:

- it does not reflect all cash expenditures, future requirements for capital expenditures or contractual commitments;

- it does not reflect changes in, or cash requirements for, working capital needs;

- it does not reflect interest expense on our debt or the cash requirements necessary to service interest or principal payments; and

- other companies in our industry may define and/or calculate this metric differently than we do, limiting its usefulness as a comparative measure.

Set forth below is a reconciliation from net income (loss) to Adjusted EBITDA for the three months and years ended December 31, 2019 and 2018, respectively:

Reconciliation of GAAP Income (Loss) to Adjusted EBITDA

About Sonim Technologies, Inc.

Sonim Technologies is a leading U.S. provider of ultra-rugged mobility solutions designed specifically for task workers physically engaged in their work environments, often in mission-critical roles. The Sonim solution includes ultra-rugged mobile phones, a suite of industrial-grade accessories, and data and workflow applications which are collectively designed to increase worker productivity, communication and safety on the job site. For more information, visit www.sonimtech.com.

Important Cautions Regarding Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to, among other things, future growth, profitability, continued market acceptance of the Company’s products. These forward-looking statements are based on Sonim’s current expectations, estimates and projections about its business and industry, management’s beliefs and certain assumptions made by the Company, all of which are subject to change. Forward-looking statements generally can be identified by the use of forward-looking terminology such as, “future”, “believe,” “expect,” “may,” “will,” “intend,” “estimate,” “continue,” or similar expressions or the negative of those terms or expressions. Such statements involve risks and uncertainties, which could cause actual results to vary materially from those expressed in or indicated by the forward-looking statements. Factors that may cause actual results to differ materially include Sonim’s ability to continue to generate positive cash flow, and ability to be profitable; anticipated trends, such as the use of and demand for its products; its ability to attract and retain customers to purchase and use its products; its ability to attract wireless carriers as customers for its products; the evolution of technology affecting its products and markets; its ability to successfully address the technical issues identified with respect to its products; its ability to introduce new products and enhance existing products, as well as the other potential factors described under “Risk Factors” included in Sonim’s Quarterly Report on Form 10-Q for the three months ended September 30, 2019 and other documents on file with the Securities and Exchange Commission (available at www.sec.gov). Sonim cautions you not to place undue reliance on forward-looking statements, which reflect an analysis only and speak only as of the date hereof. Sonim assumes no obligation to update any forward-looking statements in order to reflect events or circumstances that may arise after the date of this release, except as required by law.

Sonim Technologies Contacts

Bob Tirva, Chief Financial Officer

Sonim Technologies, Inc.

(650) 378-8100

Matt Kreps, Managing Director

Darrow Associates Investor Relations

[email protected]

(214) 597-8200